Latest progress of global 5G: from consumers to enterprises

TIME:2021-07-21

According to the statistics of GSA, by the middle of April 2021, 162 operators in 68 countries/regions have launched 5G services that meet the 3GPP standard, 89 more than a year ago (April 2020). Up to 351 5G mobile terminals have been launched or released, 243 more than a year ago. Whether from the perspective of network deployment or terminal enrichment, the global 5G is in the stage of accelerated development.

The scale of 5G users is also growing rapidly. It is also GSA's data. In the fourth quarter of 2020, the number of global 5G subscribers increased by 57% to nearly 401 million, accounting for 4.19% of the global mobile market. In terms of the absolute number of subscribers, China has become the world's largest 5G user market. According to the data released by the three major operators in the first quarter of 2021, the number of 5G subscribers in China has exceeded 390 million, or accounted for about 80% of the global market. However, from the perspective of the number of network connection users and penetration rate, South Korea is still the leading market of 5G.

Korean 5G market data reference: the penetration rate of 5G users continues to increase, but the average household flow encounters the ceiling

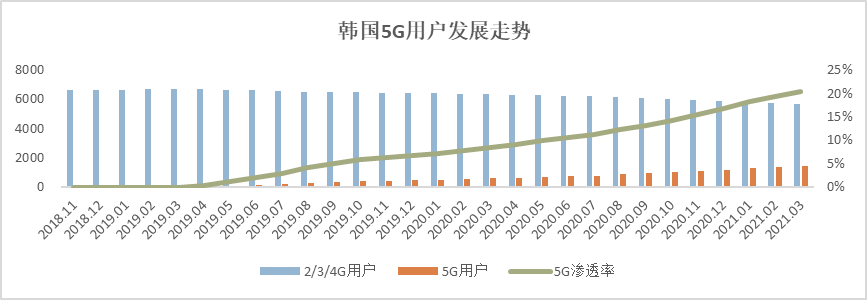

According to the data released by the Ministry of Science, Technology and Information Communication of the Republic of Korea, as of March 2021, the number of 5G subscribers in the Republic of Korea has reached 14.48 million, accounting for 20.4% of the total mobile subscribers. It should be noted that different types of users in Korean statistics are differentiated by network system. According to a similar caliber, the total number of online telephone users of 5G business in February calculated by the Ministry of Industry and Information Technology of China was about 136 million, accounting for 8.6% of the national mobile phone users.

Source: Ministry of Science, Technology and Information Communication of Korea

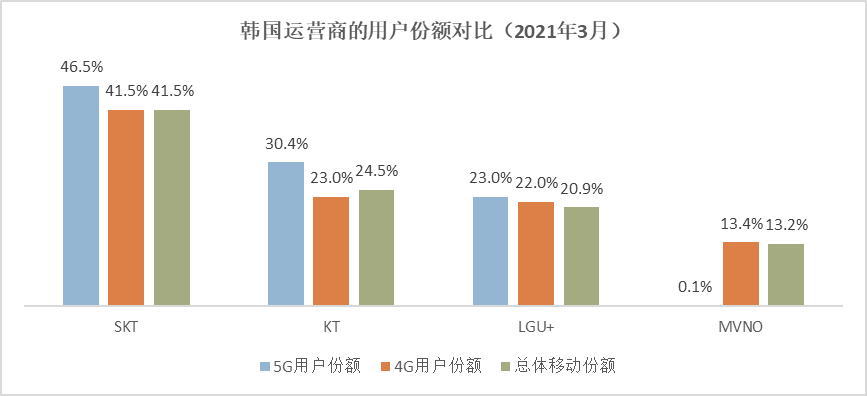

The 5G market in South Korea is still dominated by three mainstream operators. Although the Korean government has also opened 5G services to virtual operators, the current 5G users of virtual operators are not large and account for a small proportion. Without excluding the influence of the share of virtual merchants, the share of 5G users of the three mainstream operators is higher than that of 4G users in the same period. Among them, SKT is still leading in scale, while KT is outstanding in 5G share promotion.

Source: Ministry of Science, Technology and Information Communication of Korea

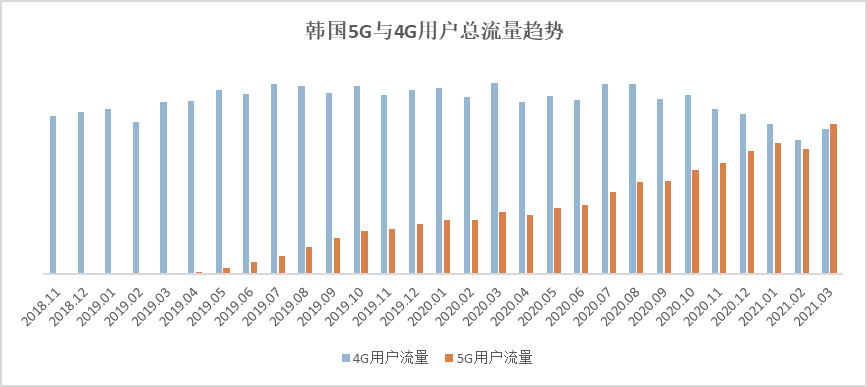

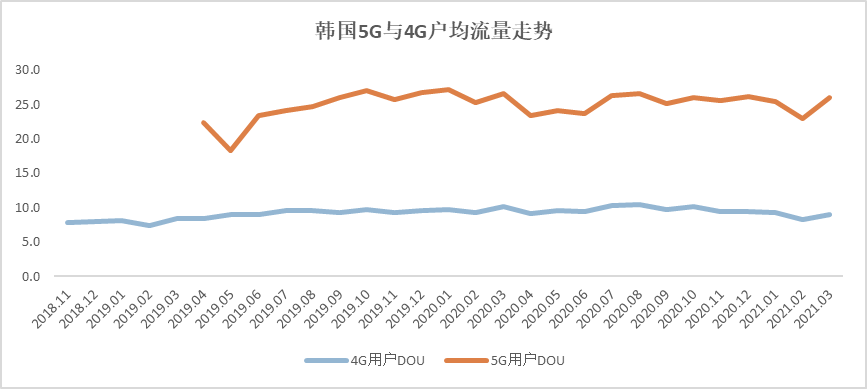

The traffic effect brought by the development of 5G users is obvious. From the data point of view, 5G user traffic is rising, while 4G user traffic is declining significantly. By March 2021, the 5G user traffic in South Korea will have exceeded the 4G user traffic. The increase or decrease of user scale is the leading factor. From the perspective of the average household flow, although the average household flow of 5G users has been better than that of 4G users at the beginning (2.5-2.9 times for a long time), it also suffers from the ceiling, and it is difficult to break through the level of 25-26GB.

Source: Ministry of Science, Technology and Information Communication of Korea

Source: Ministry of Science, Technology and Information Communication of Korea

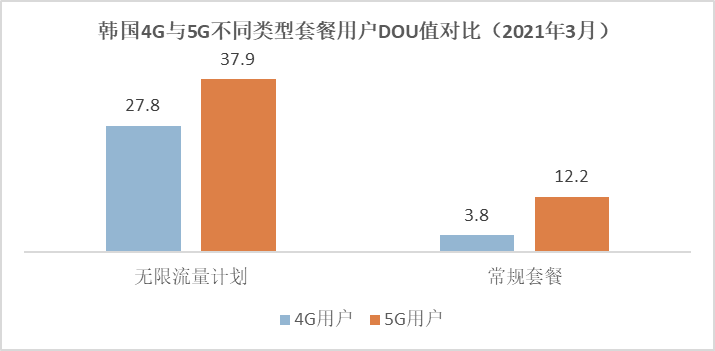

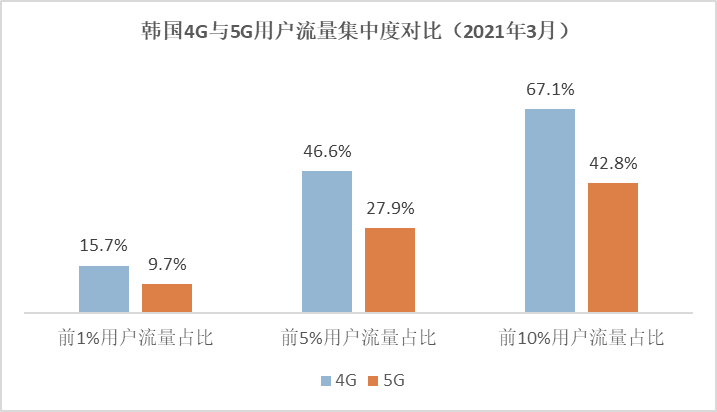

Compared with 4G users, the traffic usage of 5G users has two obvious characteristics: first, compared with the unlimited traffic plan, the average household traffic of the regular package is significantly different between 4G and 5G; Second, the traffic usage of 5G users is much more evenly distributed than that of 4G users. This shows that the cultivation of 5G traffic in South Korea is more for ordinary users than for head users. The usage rate of users with low traffic demand increased significantly after switching to 5G, thanks to the strong promotion and operation of Korean operators in 5G content.

Source: Ministry of Science, Technology and Information Communication of Korea

Source: Ministry of Science, Technology and Information Communication of Korea

5G status quo in South Korea and other major countries: shared network and dislocation competition

In South Korea, the three major mainstream operators not only have to cope with each other's competition, but also face challenges from virtual operators. As mentioned earlier, South Korea has joined the 5G competition with virtual operators. At present, there are 10 virtual operators in South Korea. They mainly adopt the strategy of low price to compete with mainstream operators for customers. For example, the new 5G plan released in April this year contains 30GB of data, and the price is about 40000 Korean won (35 US dollars), which is lower than the price of the 5G plan provided by the three mainstream operators. Besides competition, there is also cooperation. In remote coastal and rural towns, the three operators plan to speed up 5G promotion and save 5G investment through sharing networks. The promotion steps are to test the network sharing system by the end of 2021, and to complete the commercialization in stages by 2024.

Other countries other than South Korea also have their own characteristics in 5G development. Japan, the United States and the United Kingdom are selected as typical examples.

Japan: In March 2020, NTT Docomo, KDDI au and Softbank, the three major operators in Japan, launched 5G commercial services. In September of the same year, Lotte Mobile also launched 5G services in some regions. It is predicted that 5G will become the main cellular technology in Japan by 2026. By 2029, Japan will have about 45 million 4G users and more than 151 million 5G users. In addition to deploying 5G networks separately, several major operators also have a cooperative sharing model. 5G JAPAN, a joint venture between KDDI and Softbank, will mutually benefit from the base station assets owned by the two enterprises to promote infrastructure sharing, so as to accelerate the deployment of 5G networks in rural areas of Japan.

America: The market pattern of 5G has changed after commercial use. Two small operators, Sprint and T-Mobile, have started to come from behind after merging. Thanks to the Un carrier strategy, T-Mobile currently leads the other two established operators in 5G layout and progress. On the whole, the competition among the three companies is slightly misplaced. T-Mobile focuses more on the personal and family market. Verizon attaches importance to the edge layout of 5G, while AT&T focuses on the scenario layout (such as gym, education, medical care, etc.).

UK: In terms of 5G deployment, the UK is one of the most developed markets in Europe. Up to now, the four major mobile operators in the UK, EE, Vodafone, Three and O2, have launched 5G services in major cities and many small and medium-sized cities in the UK. The 5G layout routes of each company are slightly different. For example, the first EE to launch 5G services has the widest coverage of 5G networks and is currently transitioning from a non independent networking mode to an independent one; Three started late, giving priority to 5G home wireless broadband, and then spreading to individual consumers.

5G 2C strategy of operators: content, application and equipment are indispensable

At the early stage of 5G development, operators need to provide 5G featured content and applications to show consumers the functions of 5G networks, so as to promote the popularity of 5G networks. As we predicted earlier, 5G cloud games, VR/AR, etc. became the first batch of 5G content services to be launched.

According to the November Ericsson Mobility Report in 2020, up to now, there are 106 communication service providers (CSP) worldwide that have launched commercial 5G services, of which 22 have announced mobile cloud game services. Most of these CSPs cooperate with cloud game providers to provide games as separate subscriptions to game services, while the rest (only three) CSPs are bundled with the 5G data plan.

In China and South Korea, cloud games have become one of the necessary 5G featured services for operators. Although the 5G cloud games they provide exist as separate subscriptions, in fact, operators do not intend to charge too much from cloud games, and most of them are open to 5G users in the form of discounts or even free (individual games need to be paid separately). For example, KT embedded cloud games in a 5G super plan as one of the optional value-added services; LGU+provides free cloud game experience for its own users (1 hour each time), and provides 50% of the normal product discount for target customers.

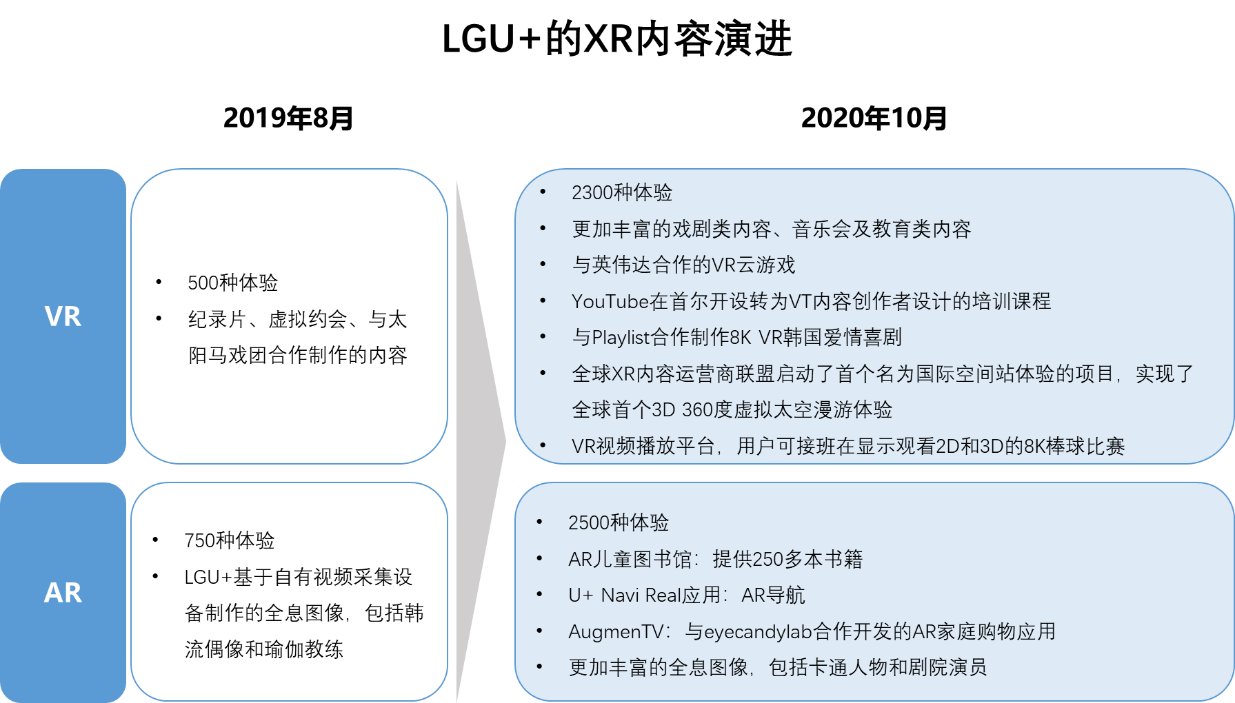

In addition to cloud games, VR/AR (hereinafter referred to as XR) is also a mobile service content emerging with 5G. In this regard, Korean operators have the operating experience that is prior to that of operators in other countries, and their operating experience is gradually enriched and mature with the continuous development of 5G. Taking LGU+as an example, 5G launched a series of XR services and supporting equipment at the beginning of its listing to attract consumers. In the following year or two, the company has continued to invest in these services, introduced and developed high-quality content through extensive cooperation, and released new supporting equipment. According to statistics, by the end of 2020, the number of XR services and devices of LGU+has been greatly expanded compared with that when it was just launched in 2019, with more than 4800 experience categories (an increase of nearly four times), and the scope of services provided has also increased significantly. These contents have become one of the main drivers of LGU+users and traffic growth. From March to October 2020 alone, LGU+'s XR content views doubled to 15 million times, with a 230% increase in total views.

Source: Strategy Analytics

In addition to the content, the popularity of 5G related equipment is also one of the key driving forces for the development of 5G. As mentioned earlier, LGU+is expanding its equipment while expanding XR content, and it is mostly sold by binding to customers. By October 2020, LGU+will have provided about 250000 devices to customers through binding, accounting for about 12% of its total 5G customers, while the matching rate of XR helmets in typical markets (without binding activities by operators) is usually 3% to 5%. Obviously, operators have improved the popularity of XR services by binding XR devices, and in fact, they have indirectly promoted the popularity of 5G among consumers.

As for 5G mobile phone, the most basic terminal equipment, operators spare no effort to promote its popularity. At present, most of the operators that have launched 5G services around the world have corresponding 5G mobile phone contract plans, which generally exchange high discount rates for customer upgrades and promises to stay online. The latest typical case is the "5G for All" initiative of T-Mobile, an American operator. T-Mobile believes that the current failure of most users to use 5G mobile phones is the biggest obstacle to the popularity of 5G. Therefore, in April this year, it added a new measure of "5G for All" to its Un carrier strategy. This new initiative includes 5G mobile service and 5G home fixed broadband, among which the most popular is the plan to provide all T-Mobile customers with 5G mobile phones for free to support their connection to the 5G network (T-Mobile's postpaid users can exchange any mobile phone with T-Mobile for a Samsung Galaxy A32 5G smartphone for free, and they need to commit to using the 5G service for 24 months). In addition, users who own 5G mobile phones (including those who have previously owned or obtained through the free upgrade plan) can also obtain the upgrade guarantee of unlimited data traffic (with a 50GB speed limit threshold). Such a big move shows the determination of operators to accelerate the development of 5G.

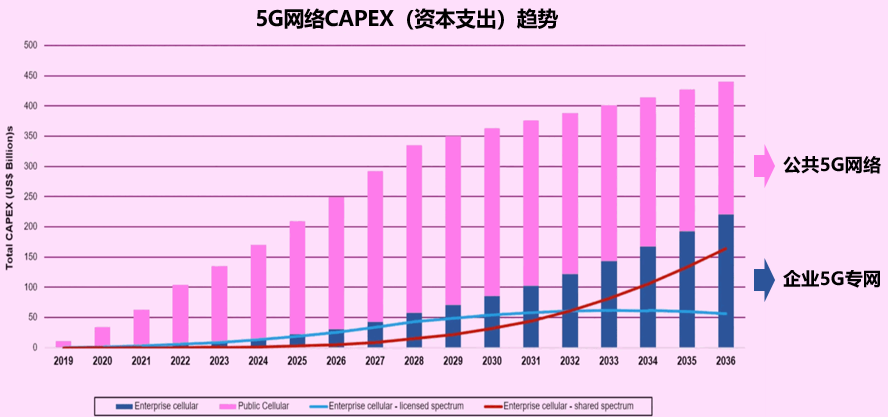

5G 2B strategy of operators: the 5G private network becomes one of the fastest landing services

Operators' exploration of 5G services in the 2B market has never stopped. From the current progress, relevant industries and operators have basically reached a consensus on the direction of 5G 2B business: the 5G private network will become one of the 5G 2B businesses with the fastest landing speed and the greatest potential in the future. As predicted by ABI Research below, in 15 years, the capital expenditure of private 5G (including 5G slice private network and 5G exclusive frequency private network) will exceed that of public 5G. This is based on the combination of multiple factors such as the wave of digital transformation demand of enterprises, 5G technology evolution, 5G equipment cost reduction, and the limitations of existing private network technologies (wired Ethernet, WLAN).

Source: ABI Research

Many governments have contributed to the promotion of 5G private networks. In Germany, Japan, the United States, the United Kingdom and other advanced countries, the government allocates private 5G frequencies to relevant enterprises at a low price, reducing the threshold for industry players other than operators to enter the 5G private network market. In South Korea, the relevant departments formulated the policy plan for 5G private network in January this year, to introduce a 5G private network market competition system by introducing local 5G operators other than traditional mainstream operators and providing them with local 5G frequencies, so as to continue to enhance the competitiveness of the domestic 5G 2B industry.

Many governments have contributed to the promotion of 5G private networks. In Germany, Japan, the United States, the United Kingdom and other advanced countries, the government allocates private 5G frequencies to relevant enterprises at a low price, reducing the threshold for industry players other than operators to enter the 5G private network market. In South Korea, the relevant departments formulated the policy plan for 5G private network in January this year, to introduce a 5G private network market competition system by introducing local 5G operators other than traditional mainstream operators and providing them with local 5G frequencies, so as to continue to enhance the competitiveness of the domestic 5G 2B industry. There have been many cases of 5G private networks at home and abroad. In these cases, the service modes provided by providers to enterprise customers are diversified. According to the domestic situation in Japan, the 5G private network services provided by various operators (including NTT Com, NEC, Fujitsu, OKI, NextGen, and Optage) can be roughly divided into the following three types: BOO mode (renting equipment, charging monthly rent), service support mode (providing services from planning, design, construction, operation to maintenance), and networking mode (Sub-6 and 5G SA combination).

Comparison and summary: China's 5G is growing rapidly under the promotion of positive factors, but there are still some hard problems

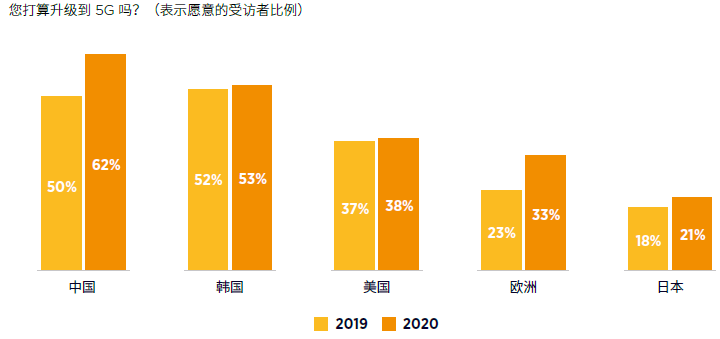

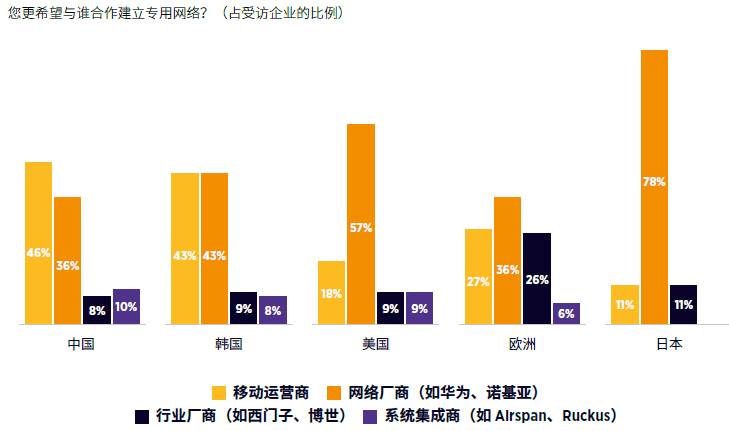

At present, China's 5G development progress is in the first echelon in the world. Compared with foreign countries, Chinese operators have a simpler competitive environment and a more positive market foundation. As Ericsson said in the 2021 China Mobile Economic Development Report, China's mobile users are more willing to upgrade 5G, and Chinese enterprises are more inclined to cooperate with mobile operators to build private networks. With the support of other policies and capital investment, China's 5G has better conditions for rapid development.

Source: Ericsson 2021 China Mobile Economy Development Report

Source: Ericsson 2021 China Mobile Economy Development Report

However, we should also see some hard defects in China's 5G development at this stage. First of all, although users are willing to upgrade, they lack the perception of 5G featured applications. The construction of 5G featured content by operators and even the entire industry chain is far from being rich, which makes it impossible for upgraded users to have more 5G experience, and user traffic cannot be released (for example, the average household traffic of 5G end users of China Telecom in March was only 15.4GB), which will also affect the upgrading attractiveness of other users. Secondly, operators have not yet developed a mature revenue model for 5G business, and it is not ideal to rely solely on traffic and overlapping packages to increase revenue. The promotion of the 2B market is still in the stage of enclosure and experience. Finally, the data of 5G package users released by operators at present can not really reflect the progress of 5G, and too loose coverage is likely to cause false prosperity in data. Fortunately, under the leadership of the Ministry of Industry and Information Technology, it is expected that a new and more practical 5G unified caliber will be released soon, and China's 5G process will embark on a more standardized path.

In the end, China's operators still have a long way to go in the exploration of 5G development. The experience cases of foreign operators mentioned above may give us some inspiration. These experiences include not only 2C content management and 2B private network operation, but also the mechanism mode of cooperation and sharing. After all, the cultivation of an emerging market cannot be done alone. Proper competition and cooperation can play a positive role in promoting the healthy and sustainable development of the industry, and operators need to work together.